Purdue student arrested after visa hearing released from ICE detention

Plus, Lafayette looks at a 66.2% increase in water rates to pay for five-year capital plan. Wabash Township turned away, again, for share in public safety income tax revenues

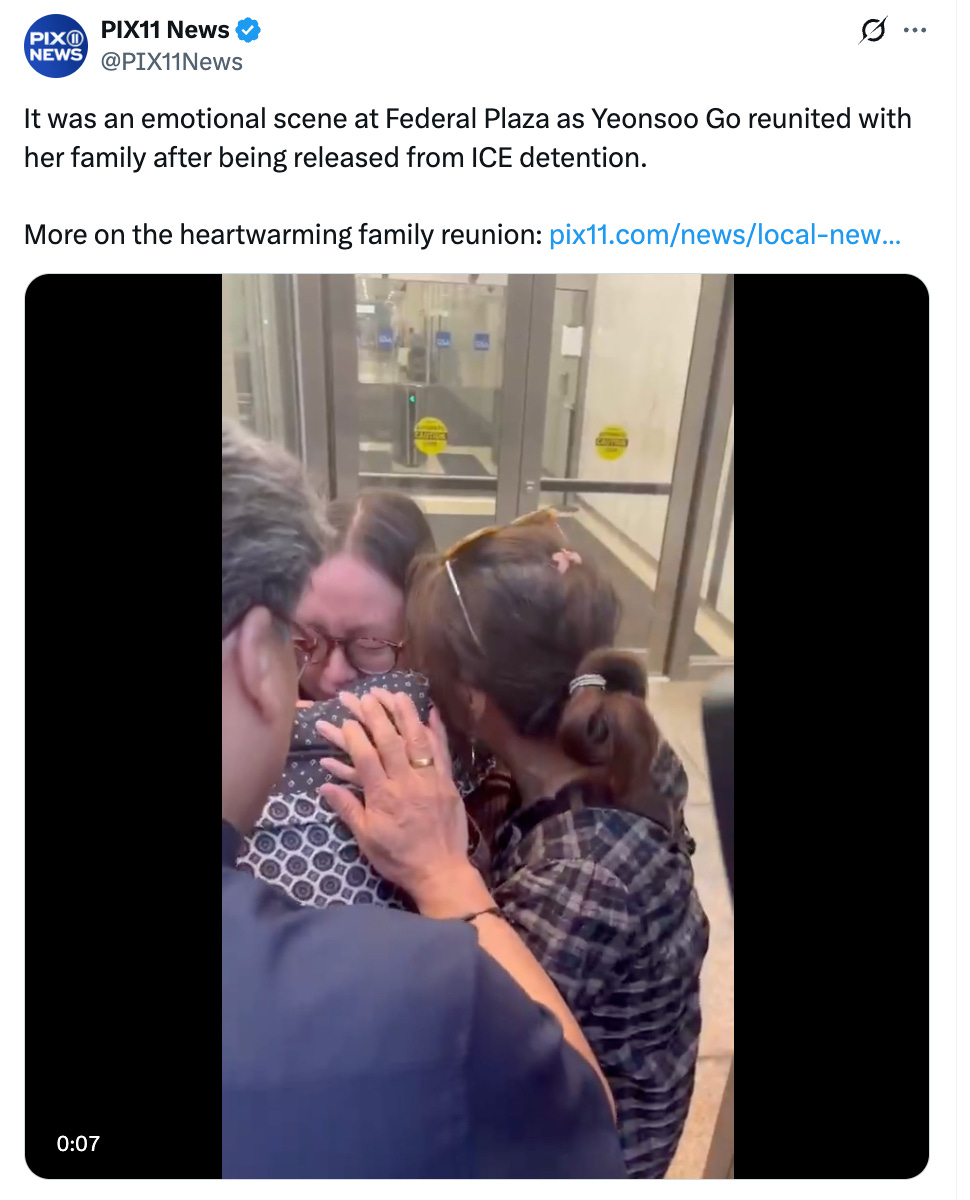

Media reports Monday evening confirmed that Yeonsoo Go, a Purdue student detained five days earlier by ICE agents after a visa hearing in New York, was released after being returned to New York City from a detention center in Louisiana.

Go, who graduated from a high school in Scarsdale, New York, and the daughter of an Episcopal priest living in the U.S. on a religious dependent visa since 2021, was released after a weekend of protests pushing to let her go.

“Everything just feels surreal,” Go said as she was walked out of federal detention with her mother, Rev. Kyrie Kim, according to reporting by Pix11 in New York.

For more, here’s the full Pix11 report: “NY high school grad detained by ICE released.”

Ahead of that, Purdue released a brief statement about the situation: “There have been media reports of a visa situation involving one of our students. The dean of students’ office has reached out to the student’s family.”

State Rep. Chris Campbell, a West Lafayette Democrat whose district includes Purdue, railed on the situation, calling for Go’s release.

“This is absolutely horrifying,” Campbell said. “Yeonsoo Go is a young woman who came to the U.S. on a legal, religious worker’s dependent visa. An attorney for the Episcopal Diocese in New York, where Go’s mother serves as a priest, says that her current visa doesn’t even expire until December. Go is trying to update her paperwork; she’s following the law, but ICE grabbed her outside of court. Arresting people outside of the courthouse proves that this isn’t about legal immigration. It’s even more concerning that her parents found out about her transfer to Louisiana from online records. It’s cruel.”

66% INCREASE PROPOSED IN LAFAYETTE WATER RATES TO PAY FOR WELLFIELD, NEW MAINS, LEAD SERVICE LINE REPLACEMENT

Lafayette water rates for a household using 5,000 gallons a month would go up 66.2% by 2027, according to a plan initiated Monday by the Lafayette City Council.

The increases on a monthly bill covering 5,000 gallons would step up from $17.81 to $23.32 in summer 2026 and to $29.61 in 2027, according to a schedule laid out for the council.

Mayor Tony Roswarski said the increase – the first since 2018 – would back a five-year, $64 million capital improvement plan for the city’s water utility.

That would include:

A new well field to complement the city’s Canal Road and Glick well fields. The city has been studying and drilling in different locations in the past year.

Water main extensions to service areas south of the city to help open ground for residential, commercial and industrial development.

And continuation of a $30 million federally mandated project to replace lead service lines to 3,200 homes, started in 2024 in some of Lafayette’s oldest blocks.

The proposal would have to go through the Indiana Utility Regulatory Commission, in a process that could take a year, Roswarski said.

“There will be public hearings and meetings and different groups will take a look at this, and maybe it won't get approved exactly like we're asking for,” Roswarski said. “We'll just have to wait and see.”

On Monday, the city council also authorized a bond issue of up $70 million for the water projects, which wouldn’t happen until the IURC issued a decision on the rate increases.

WABASH TOWNSHIP’S PLEA FOR CUT OF PUBLIC SAFETY INCOME TAX TURNED AWAY, AGAIN

Wabash Township’s request to get a piece of a countywide public safety local income tax was denied Monday night by the Lafayette City Council.

It was the second time in the past four weeks that the township’s $600,000 plea – intended to upgrade the Wabash Township Fire Department’s radios – was turned away. In July, the Tippecanoe County Council voted 4-2 not to go forward with Wabash Township Trustee Angel Valentin’s request.

The Lafayette City Council didn’t vote on the matter, instead moving on to other matters after the city’s police and fire chiefs and Mayor Tony Roswarski recommended against considering a new distribution for an income tax in place since 2019.

“I have sympathy for what's happening,” Roswarski said.

But the mayor said revenues from the public safety local income tax had been baked into the city’s moves aimed as police and fire protection, including what he said eventually would be another fire station to help with growth to the south, a schedule of replacement fire equipment and bond payments on the city’s Public Safety Center across from city hall.

“We put ourself on a strategic plan, many years ago, to do all these things,” Roswarski said.

Wabash Township officials argued that of the $58.6 million collected since 2019, roughly $5.8 million of that came from residents living in the unincorporated parts of the township along the edges of West Lafayette, while zero has gone to Wabash Township or other townships. They made the case that the Wabash Township Fire Department, covering 39 square miles west, south and north of West Lafayette, was looking at an 18.2% increase in runs in 2025, after a 16.4% increase in 2024. They also argued that the township needs to keep up with growth in an unincorporated area where population has grown from 17,613 in 2011 to 20,735 in 2020 and is expected to grow to more than 32,000 by the early 2030s.

This year wasn’t the first time Wabash Township had asked for a cut of the 0.18% income tax since it was created. The past two years, Valentin asked for $250,000 each time, never getting a hearing from the local tax board.

The difference this year with Wabash Township’s $600,000 request was a new state law that now requires members of what’s called the Tippecanoe County Income Tax Council – made up of officials from Tippecanoe County, Lafayette, West Lafayette and the towns of Battle Ground, Clarks Hill, Dayton, Otterbein and Shadeland – to hold a public hearing when a township asks for some of that money. Each of those bodies gets a weighted vote on local income tax questions.

Wabash Township, or any township, essentially would need the blessing of two of the biggest three – Lafayette, West Lafayette and Tippecanoe County – to get past that 50% threshold for approval or denial.

“I agree with what maybe some of you guys have thought: What is Wabash Township doing at a Lafayette City Council meeting, asking us for money?” Ed Ward, Wabash Township fire chief, said. “I agree it's a very asinine process, but it is what it is. We have to ask, because this is how the process plays out.”

In July, County Auditor Jennifer Westin told the county council that Wabash Township’s $600,000 would come off the top of the total $12 million in anticipated revenues, meaning roughly $278,000 less for the county, $239,000 less for Lafayette and $72,000 less for West Lafayette.

Rejected by two of those now, Valentin said Monday that he didn’t plan to make a similar presentation to the West Lafayette City Council ahead of a Sept. 1 deadline for requests for local income tax revenues.

“Wabash Township needs to receive its fair share of the fire and EMS dollars that our township residents have already paid for in income taxes, so that we can invest in our critical capital and personnel needs,” Valentin said after Monday’s meeting.

“Our unincorporated area's constituents contribute to our cities and our county's economy, and they pay toward this public safety tax, but they don't get their fair share of the collected funds because it has been kept out of our department's reach by the LIT Council,” Valentin said. “Lafayette's plans to invest in additional stations and their aggressive apparatus replacement schedules were highlighted as part of the reason for why now isn't the right time to approve our request. We have the same needs at a smaller scale, in a growing service area that will have 32,000 residents in coming years.”

For more:

Thank you for supporting Based in Lafayette, an independent, local reporting project. Free and full-ride subscription options are ready for you here.

Tips, story ideas? I’m at davebangert1@gmail.com.

The new state laws regarding "cuts" at the state level are now playing out, as opponents have predicted, in short-changing local government entities. Wabash Township Trustee Valentine has a point and so does City of Lafayette Mayor Roswarski, But who set these two responsible officials against each other? Governor Mike Braun and the "super-majority" Republican Party.

Taxing ourselves (charging ourselves) for essential government services is important. Perhaps new development on the South End should include water prices that entirely cover what it costs the city to install new infrastructure. That way existing citizens aren't charged for growth they had no say in. But, the basic principal of taxing ourselves for government services is essential.